inheritance tax rate colorado

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Luckily the basic exemption for federal taxes is high so that most estates wont have to pay an.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

. What is the colorado inheritance tax rate. Nevertheless the Federal Gift Tax has an annual exclusion amount of 16000. There is no estate or inheritance tax collected by the state.

However Colorado residents still need to understand federal estate tax laws. Ask Your Own Tax Question. In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the inheritance tax rate is 0.

The state and average local sales tax rate is 539. The rate goes back to. In 2021 this amount was 15000 and in 2022 this amount is 16000.

Spouses in colorado inheritance law Use schedule e on. Inheritance Tax Calculator Colorado. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

Until 2005 a tax credit was allowed for federal estate. For the 2021 tax year Colorado has a flat income tax rate of 45. The nil rate band is currently 325000 per individual providing this allowance hasnt been used by making gifts or settling assets into.

Twelve states and the district of columbia impose estate taxes and six. The good news is that since 1980. It is the most efficient.

A state inheritance tax was enacted in Colorado in 1927. Spouses in colorado inheritance law Use schedule e on. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35.

Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. Spouses in colorado inheritance law Use schedule e on. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

It was lowered from 455 to 45 because of a high fiscal year revenue growth rate. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. It means that anyone can make up to 16000 for gifts to as many people every year.

What is the colorado inheritance tax rate. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. Colorado does not have inheritance taxes but there are federal estate taxes.

When it comes to federal tax law. Inheritance Tax Rate Colorado.

Colorado Estate Tax The Ultimate Guide Step By Step

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Colorado Health Legal And End Of Life Resources Everplans

State By State Comparison Where Should You Retire

Estate Tax Rates Forms For 2022 State By State Table

Colorado Property Tax Calculator Smartasset

The Death Tax Isn T So Scary For States Tax Policy Center

A New Era In Death And Estate Taxes

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Transfer On Death Tax Implications Findlaw

Colorado Estate Tax The Ultimate Guide Step By Step

State Taxes On Capital Gains Center On Budget And Policy Priorities

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

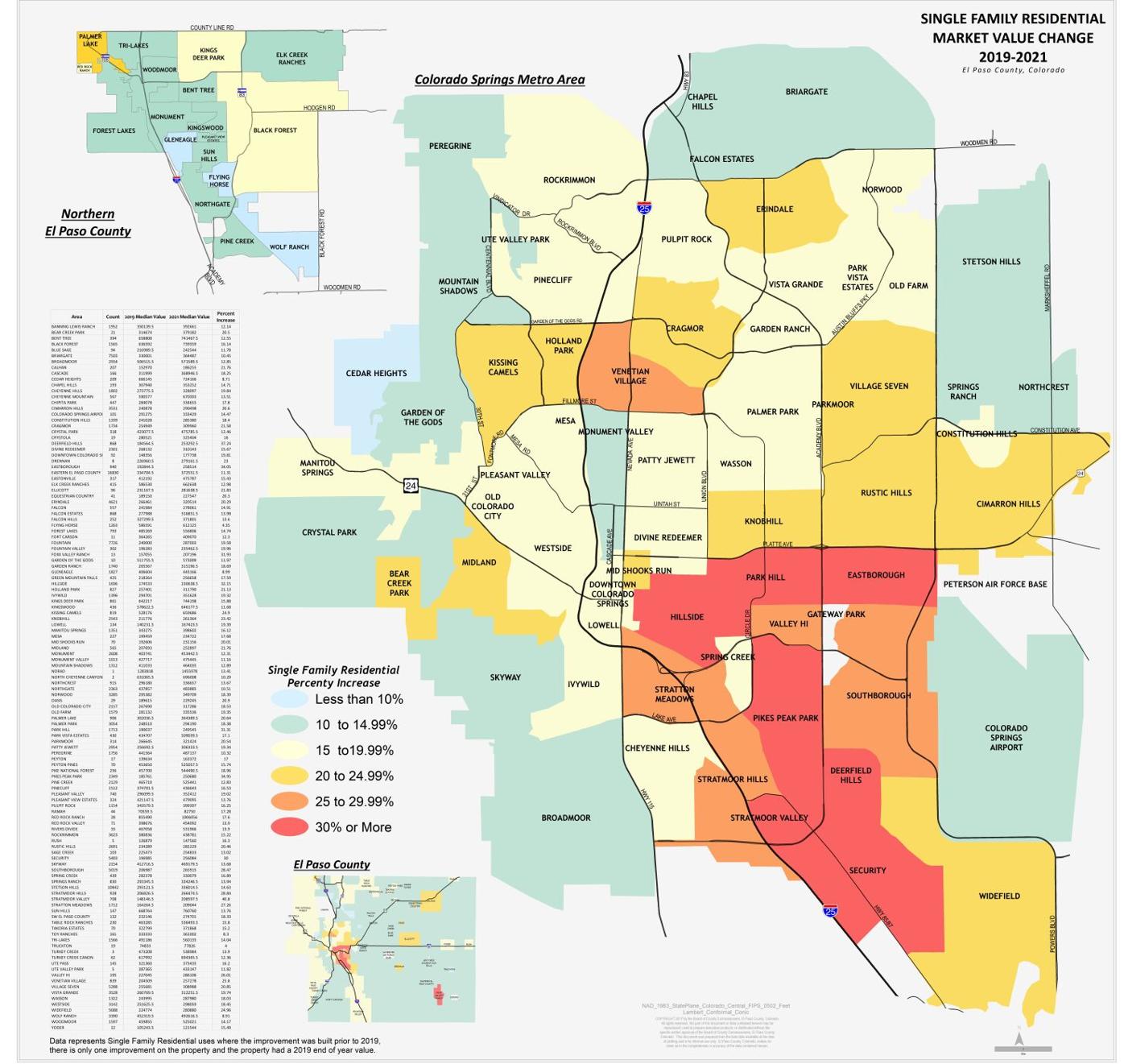

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

Colorado Estate Tax Do I Need To Worry Brestel Bucar

These Denver Neighborhoods Are Getting The Biggest Property Tax Hikes Denverite The Denver Site